Equitable Distribution of Resources

People for a Just World

Fair Share For All

“No person, I think, ever saw a herd of buffalo, of which a few were fat and the great majority lean. No person ever saw a flock of birds, of which two or three were swimming in grease, and the others all skin and bone.” –Henry George, American political economist (1839-1897)

Fair Allocation of Resources Plays a Crucial Role in Establishing a Just Society

1. The fair allocation of resources plays a crucial role in establishing a just society. When resources such as wealth, education, and healthcare are distributed equitably, it ensures that all individuals have access to the opportunities they need to thrive. This equitable distribution fosters a sense of community and belonging, as everyone feels valued and supported, regardless of their background or circumstances. A society that prioritizes fairness in resource distribution is more likely to experience social harmony and reduced conflict among its members.

2. In a just society, the importance of equitable resource distribution cannot be overstated. It serves as the foundation for social justice, allowing individuals to pursue their goals and aspirations without facing systemic barriers. When resources are allocated fairly, it helps to level the playing field, enabling marginalized groups to gain access to the same opportunities as those who are more privileged. This not only empowers individuals but also contributes to the overall progress and development of society as a whole.

3. Ultimately, the equitable distribution of resources is essential for fostering a sense of trust and cooperation among citizens. When people see that resources are shared fairly, they are more likely to engage in civic activities and contribute positively to their communities. This collective effort can lead to innovative solutions to societal challenges and a stronger, more resilient society. By prioritizing fairness in resource distribution, we can create an environment where everyone has the chance to succeed and contribute to the common good.

The Negative Impact Equitable Distribution of Resources with Some Groups Being Underserved

– The unequal allocation of resources can lead to significant disadvantages for certain groups within society, leaving them underserved and lacking essential support.

– When resources are distributed inequitably, it creates a gap that can hinder the growth and development of marginalized communities.

– Certain populations may find themselves without access to vital services, education, or healthcare, which can perpetuate cycles of poverty and inequality.

– The failure to provide equitable resources can result in a lack of opportunities for individuals in underserved groups, limiting their potential for success.

– Disparities in resource distribution can foster feelings of frustration and disenfranchisement among those who feel overlooked or neglected by the system.

– Communities that are consistently underserved may struggle to advocate for their needs, further entrenching the inequities they face.

– The negative consequences of resource inequity can ripple through generations, affecting not just individuals but entire communities and their future prospects.

– Addressing the issue of equitable resource distribution is crucial for fostering social justice and ensuring that all groups have the opportunity to thrive.

– Policymakers must recognize the importance of inclusive resource allocation to create a more balanced and fair society for everyone.

– By prioritizing equitable distribution, we can work towards a future where all individuals have access to the resources they need to succeed and contribute positively to their communities.

The risk of having taxpayers funding high salaries, lavish healthcare benefits and generous pensions that taxpayers don’t get close to receiving from their employment

1. It is concerning to consider the potential burden placed on taxpayers who are financing exorbitant salaries, extravagant healthcare packages, and substantial pension plans that they themselves are unlikely to enjoy in their own careers. This disparity raises questions about fairness and equity in the distribution of public funds, as many citizens struggle to make ends meet while their contributions support benefits that seem out of reach for the average worker. The implications of this system not only affect the financial stability of taxpayers but also foster a growing sense of disillusionment with public service compensation structures.

2. The reality that taxpayers are shouldering the financial responsibility for high salaries and extensive benefits for public employees can lead to a significant disconnect between the public and those in positions of authority. Many individuals in the workforce are left feeling undervalued and undercompensated, especially when they see their hard-earned money being allocated to perks that they themselves do not receive. This situation can create a rift in trust between the government and the citizens it serves, as taxpayers may question the justification for such lavish expenditures in a time when many are facing economic challenges.

3. It is imperative to address the growing concern surrounding the funding of generous compensation packages for public employees at the expense of the average taxpayer. By reevaluating the structure of these benefits, we can work towards a more equitable system that reflects the realities faced by the general populace. Ensuring that taxpayer dollars are spent in a manner that promotes fairness and accountability will not only restore faith in public institutions but also foster a more sustainable economic environment for all citizens.

Yes, the average pension for retired New York City Fire Department (FDNY) members is higher than the median household income in the outer boroughs

HOW IS IT POSSIBLE? HOW IS THIS FAIR?

New York City’s Relationship With the FDNY & The Union That Represents Them

NYC IS KNOWN FOR GIVING THE FDNY’S UNION WHATEVER THEY WANT

The city of New York has long been accused of pandering to the powerful firefighters’ union, often prioritizing the demands and interests of this influential labor organization over the broader needs and concerns of the public. Critics argue that the political clout wielded by the firefighters’ union has allowed it to extract disproportionate concessions and benefits from city officials, who are beholden to the union’s ability to mobilize voters and sway elections. This dynamic has allegedly manifested in inflated salaries and pensions for firefighters, lax disciplinary standards, and the maintenance of overstaffed fire departments, all of which strain municipal budgets but are defended by union leaders as necessary for public safety. Proponents of this view contend that the city government’s coziness with the firefighters’ union has compromised its objectivity and allowed the union to block reforms or accountability measures that could improve the efficiency and cost-effectiveness of fire services. While the firefighters’ union maintains that it is simply advocating for the interests of its members and the communities they serve, the persistent allegations of pandering highlight the delicate balance that city leaders must strike between respecting the rights of organized labor and upholding the broader public good.

FDNY’s SALARIES HAVE BEEN QUESTIONED

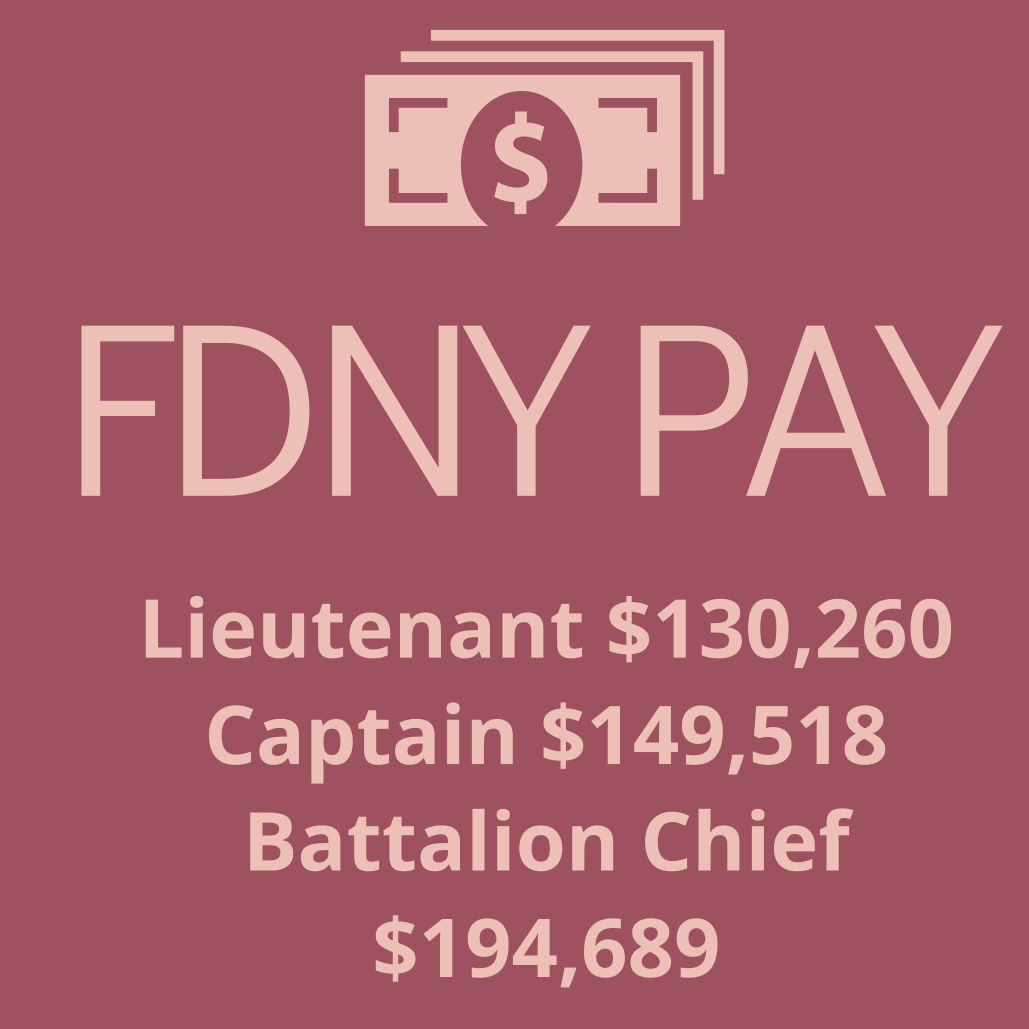

New York City’s firefighter salaries have long been a source of controversy and criticism. As one of the highest-paid fire departments in the country, the FDNY’s compensation packages have drawn scrutiny from both local and national observers. Critics argue that the city’s firefighters are grossly overpaid, with starting salaries well over $50,000 per year and the potential to earn six-figure incomes with overtime and hazard pay. They contend that these lavish salaries, which far exceed the median income in New York, place an undue burden on taxpayers and divert funding away from other essential city services. Proponents, on the other hand, counter that the job’s immense risks, intense training requirements, and vital public safety role justify the generous pay scale. They point to the physically and emotionally demanding nature of firefighting, as well as the need to attract and retain top talent in the nation’s largest and busiest fire department. The debate over FDNY salaries has raged for decades, with neither side willing to back down. Ultimately, it reflects the broader tensions in New York between maintaining competitive public sector compensation and controlling municipal spending – a delicate balance that the city has struggled to strike when it comes to its celebrated firefighters.

FDNY IS ONE OF THE HIGHEST PAID IN THE UNITED STATES

The New York City Fire Department, commonly known as the FDNY, is widely recognized as one of the highest-paid fire departments in the United States. Compared to many other municipal fire departments across the country, the salaries and benefits offered by the FDNY are quite substantial. Starting firefighters in the FDNY can expect to earn a base salary of over $45,000 per year, with the potential to reach over $85,000 annually for more experienced and higher-ranking personnel. This is significantly higher than the national average for firefighter salaries, which typically range from $30,000 to $50,000 per year. The generous compensation package for FDNY firefighters is a reflection of the department’s status as one of the busiest and most demanding fire services in the world. New York City faces unique fire safety challenges due to its high population density, expansive infrastructure, and the sheer volume of emergency calls the department responds to on a daily basis. To attract and retain the best firefighting talent, the FDNY offers a combination of competitive base pay, robust overtime opportunities, and a comprehensive benefits program that includes premium health insurance, disability coverage, and a lucrative pension plan. This level of remuneration helps the FDNY maintain its reputation as an elite, highly-skilled fire department capable of providing the city’s residents with world-class emergency response and fire protection services.

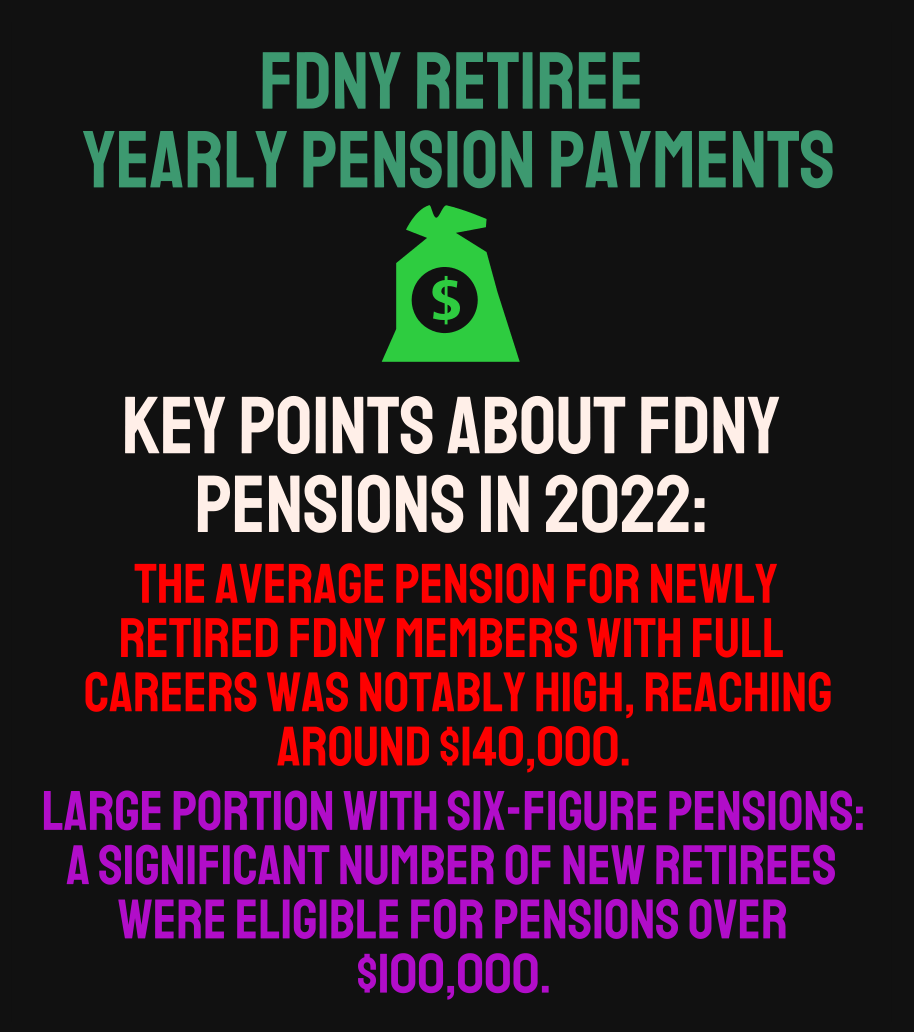

The FDNY (Fire Department of New York) is renowned for its exceptional pension system, offering firefighters and emergency medical personnel some of the most generous retirement benefits in the country. Compared to other fire departments, the FDNY pension program stands out as a shining example of the city’s commitment to those who put their lives on the line to protect its citizens. The pension plan provides a secure financial future for FDNY retirees, allowing them to enjoy a comfortable lifestyle after decades of courageous service. Firefighters who retire from the FDNY can expect to receive a pension equal to roughly 50% of their final year’s salary, with the potential for even higher benefits depending on factors like years of service and specialized training. This is a substantially more robust pension than what is typically offered by other municipal fire departments, which often max out at 40% or less of an employee’s final pay. Additionally, FDNY retirees enjoy comprehensive health insurance coverage that extends into their golden years, a rarity in many other public sector pension plans. The city also provides a host of other financial protections, such as disability benefits and death benefits for the families of firefighters killed in the line of duty. This unparalleled pension system is a point of immense pride for the FDNY, serving as a powerful recruitment and retention tool to maintain the department’s world-class standards of excellence.

THE FDNY PENSION & MEDICAL BENEFITS ARE SOME OF THE BEST COMPARED TO ALL WORKERS IN THE UNITED STATES… WHILE OTHER CITY EMPLOYEES WORK LONGER AND RECIEVE LESS

The retirement benefits of New York City employees can vary significantly depending on the specific job and department. While the FDNY (Fire Department of New York) and NYPD (New York Police Department) are often viewed as having some of the most robust retirement packages, other municipal workers may have quite different compensation structures. For example, civilian city office workers, sanitation employees, and teachers often have retirement plans that are more in line with private sector standards, involving defined contribution plans like 401(k)s rather than traditional pensions. The pension formulas and eligibility requirements can also differ, with FDNY and NYPD personnel generally able to retire at younger ages and with higher percentage of their final salaries compared to many other city jobs. Additionally, healthcare coverage in retirement is an important factor, and first responders like firefighters and police officers may receive more comprehensive retiree medical benefits than other public sector workers. The disparity in retirement perks reflects the unique physical demands and risks associated with certain roles, as the city aims to provide appropriate compensation and incentives. Overall, while FDNY and NYPD employees enjoy some of the most generous retirement plans, the benefits for other municipal workers can vary widely based on their specific job classification and collective bargaining agreements.

MOST TAXPAYERS WHILE FUNDING AMAZING RETIREMENT BENEFITS FOR THE FDNY & NYPD WILL STRUGGLE TO SAVE ENOUGH TO RETIRE COMFORTABLE OR NEVER RETIRE AT ALL

The retirement benefits for the average New York City resident often pale in comparison to those enjoyed by members of the New York City Fire Department (FDNY) and the New York City Police Department (NYPD). While the typical NYC citizen must rely on a combination of Social Security, personal savings, and any employer-sponsored retirement plans, the retirement packages for FDNY and NYPD personnel are generally far more robust and generous. FDNY and NYPD employees are eligible for defined-benefit pension plans that provide a guaranteed monthly payment for life upon retirement, with the pension amount based on factors like years of service and final average salary. In contrast, most private-sector workers in NYC have defined-contribution plans like 401(k)s, which do not promise a specific monthly benefit and rely more heavily on investment performance. FDNY and NYPD retirees also commonly receive additional benefits like health insurance coverage, cost-of-living adjustments to their pensions, and opportunities for overtime pay that can significantly boost their retirement income. This stark disparity in retirement benefits is largely due to the dangerous and essential nature of the work performed by firefighters and police officers, as well as the political influence wielded by their powerful unions. As a result, the average NYC resident often envies the robust retirement security enjoyed by their FDNY and NYPD counterparts, who can look forward to a comfortable post-career lifestyle that most private-sector workers can only dream of.

The cost of retired FDNY (Fire Department of New York) members to the city of New York can be quite substantial. Each retired firefighter or EMT (Emergency Medical Technician) who has served their time with the FDNY and transitioned into retirement represents a long-term financial obligation for the city. This is because the FDNY, like many public service departments, provides its members with generous pension and healthcare benefits that continue well after they stop actively working. The specific annual cost per retired FDNY member can vary, but estimates suggest it averages anywhere from $100,000 to $150,000 or more. This covers the pension payments made to the retiree as well as the healthcare premiums and out-of-pocket costs associated with the retiree and their dependents utilizing the city’s medical insurance plans. With thousands of FDNY members retiring each year and living for decades in retirement, the cumulative cost to the city can add up quickly into the billions of dollars annually. Maintaining this robust benefits package is seen by many as a necessary way to attract and retain top talent in the FDNY, but it also represents a major ongoing expense that New York City must budget for and manage as part of its overall municipal finances.

Homelessness is a pervasive and heartbreaking issue affecting far too many children in New York City. According to the latest data, there are over 114,000 students in the New York City public school system who are classified as homeless – meaning they are living in shelters, motels, or other temporary housing situations, or are completely unsheltered on the streets. This staggering statistic underscores the sheer scale of the homelessness crisis impacting the city’s youth. Many of these children have been displaced from their homes due to factors beyond their control, such as job loss, domestic violence, or skyrocketing housing costs that have priced families out of stable living situations. Lacking a permanent place to call home, these vulnerable young people face immense challenges – from difficulty accessing education and healthcare, to emotional trauma and social isolation. Tragically, New York City has the highest rate of child homelessness of any major U.S. city, a grim reality that speaks to the urgent need for expanded affordable housing, stronger social services, and more robust support systems to protect the city’s children from the devastating consequences of homelessness. Addressing this crisis and ensuring all kids have access to safe, stable living conditions must be an absolute priority for lawmakers and community leaders alike.

The cost of each retired NYPD member to New York City is a significant financial burden that the city must bear. When an NYPD officer retires, they are entitled to a pension and healthcare benefits that can last for decades after their active service has ended. On average, the city pays out over $100,000 per year in pension and healthcare costs for each retired NYPD member. This money comes directly from the city’s budget, placing a heavy strain on the resources available for other essential public services like education, infrastructure maintenance, and social programs. The sheer number of NYPD retirees, which can number in the tens of thousands at any given time, compounds this financial challenge exponentially. Compounding the issue is the fact that many NYPD officers retire at relatively young ages, often in their 40s or 50s, meaning the city may be responsible for providing these benefits for 30 or more years per retiree. The high cost of NYPD pensions and healthcare is a major budgetary concern for New York City, requiring city leaders to carefully balance the needs of current and former officers against the broader needs of the population. Addressing this burden remains an ongoing challenge as the city seeks to provide fair compensation for its dedicated police force while also maintaining fiscal responsibility.

Food insecurity is a significant issue affecting many children in New York City. According to recent data, an estimated 1 in 5 NYC kids, or around 300,000 children, are considered food insecure. This means they lack consistent access to adequate, nutritious food, often due to financial constraints or other socioeconomic barriers. For these vulnerable young New Yorkers, getting enough to eat on a regular basis can be an immense challenge. Many come from low-income families where money is tight, parents may be working multiple jobs, and the costs of housing, utilities, and other basic necessities leave little leftover for a proper, balanced diet. As a result, these children may go to school hungry, have difficulty concentrating, and face developmental delays or health problems stemming from poor nutrition. Food pantries, school meal programs, and other charitable initiatives aim to help address this crisis and ensure all kids in the five boroughs have their fundamental nutritional needs met. But with such a large population of food-insecure minors, the problem remains widespread and persistent, highlighting the need for more systemic solutions to tackle child hunger in the nation’s largest city.

New York City firefighters and fire officers retiring last year after full careers were entitled to average annual pension benefits of $151,676

That is up six percent from the prior year, according to new data added to SeeThroughNY.net, the Empire Center’s government transparency website.

Among the 470 new retirees with at least 20 years of service, nearly eight out of ten (399) were eligible for six-figure pensions; 79 were eligible for pensions over $200,000.

Looking at the most recent data for all New York City Fire Pension Fund retirees, the average pension for all 15,796 FDNY retirees, as of fiscal year 2024, came to $93,905, up 52 percent from $61,560 a decade ago. Both amounts include in-service disability payments for some.

Five hundred and eighty-four retirees were eligible for pensions over $200,000, 26 percent more than the previous year’s total of 464. Out of these, 11 were eligible for pensions over $300,000. As shown in the chart below, as the total number of retirees remained consistent over the last decade, the share of retirees eligible for six-figure pensions has soared, tripling during that time.

NYC Residents Funding Benefits They Do Not Have

Taxpayers fund benefits for government employees, even if they don’t receive them themselves, because it is considered necessary to attract and retain a qualified workforce for essential public services, which can include competitive salaries and comprehensive benefits packages that might not be readily available in the private sector, ultimately benefiting the entire community served by the government employees.

Key points to consider:

-

Public service value:

-

Government employees provide crucial services like public safety, education, infrastructure maintenance, and healthcare, which directly impact the quality of life for citizens.

-

Market competition:

-

To attract and retain qualified individuals in these critical roles, governments often need to offer competitive compensation packages including benefits like pensions, health insurance, and paid time off, which may be more generous than what private sector jobs offer in similar positions.

-

Stability and continuity:

-

Providing stable employment with attractive benefits can help ensure continuity in government operations and prevent frequent turnover, which can disrupt services.

-

Public accountability:

-

While taxpayers fund these benefits, government employees are accountable to the public through oversight mechanisms and elections.

The retirement benefits of New York City employees can vary significantly depending on the specific job and department. While the FDNY (Fire Department of New York) and NYPD (New York Police Department) are often viewed as having some of the most robust retirement packages, other municipal workers may have quite different compensation structures. For example, civilian city office workers, sanitation employees, and teachers often have retirement plans that are more in line with private sector standards, involving defined contribution plans like 401(k)s rather than traditional pensions. The pension formulas and eligibility requirements can also differ, with FDNY and NYPD personnel generally able to retire at younger ages and with higher percentage of their final salaries compared to many other city jobs. Additionally, healthcare coverage in retirement is an important factor, and first responders like firefighters and police officers may receive more comprehensive retiree medical benefits than other public sector workers. The disparity in retirement perks reflects the unique physical demands and risks associated with certain roles, as the city aims to provide appropriate compensation and incentives. Overall, while FDNY and NYPD employees enjoy some of the most generous retirement plans, the benefits for other municipal workers can vary widely based on their specific job classification and collective bargaining agreements.

The retirement benefits for the average New York City resident often pale in comparison to those enjoyed by members of the New York City Fire Department (FDNY) and the New York City Police Department (NYPD). While the typical NYC citizen must rely on a combination of Social Security, personal savings, and any employer-sponsored retirement plans, the retirement packages for FDNY and NYPD personnel are generally far more robust and generous. FDNY and NYPD employees are eligible for defined-benefit pension plans that provide a guaranteed monthly payment for life upon retirement, with the pension amount based on factors like years of service and final average salary. In contrast, most private-sector workers in NYC have defined-contribution plans like 401(k)s, which do not promise a specific monthly benefit and rely more heavily on investment performance. FDNY and NYPD retirees also commonly receive additional benefits like health insurance coverage, cost-of-living adjustments to their pensions, and opportunities for overtime pay that can significantly boost their retirement income. This stark disparity in retirement benefits is largely due to the dangerous and essential nature of the work performed by firefighters and police officers, as well as the political influence wielded by their powerful unions. As a result, the average NYC resident often envies the robust retirement security enjoyed by their FDNY and NYPD counterparts, who can look forward to a comfortable post-career lifestyle that most private-sector workers can only dream of.

The Residents of New York City are Struggling

Living Paycheck to Paycheck

According to recent studies, a significant portion of New York City’s population is living paycheck to paycheck, struggling to make ends meet and lacking the financial cushion necessary to weather unexpected expenses or disruptions in income. The high cost of living in the city, driven by exorbitant rents, steep taxes, and the premium placed on basic necessities, leaves many residents with little to no disposable income after covering their essential obligations. This precarious financial situation is exacerbated by the prevalence of low-wage jobs, irregular work schedules, and a lack of access to affordable healthcare and other social safety net programs. With little to no savings to fall back on, a single car repair, medical bill, or other unplanned cost can quickly throw the household budget into disarray, forcing difficult decisions and tradeoffs that undermine financial stability and long-term security. The strain of living paycheck to paycheck also takes a heavy emotional and psychological toll, as families are forced to constantly prioritize immediate needs over long-term planning and the pursuit of personal goals. Addressing this crisis will require a multifaceted approach involving policy reforms, investment in affordable housing, and initiatives to boost wages and provide more comprehensive financial support for New York City’s most vulnerable residents.

Living on the Street

New York City has a significant homeless population, and there are a number of ways the city can work to address this pressing issue. One key approach would be to expand access to affordable housing and shelter options. This could involve investing in the development of more low-income and subsidized housing units, as well as increasing the availability of emergency shelters and transitional housing programs. Additionally, the city could implement policies to protect tenants from eviction and prevent homelessness before it occurs. Providing comprehensive support services is another crucial component – this might include expanding access to mental health and addiction treatment, job training and placement assistance, and financial counseling to help the homeless get back on their feet. The city could also work to change public perceptions and reduce the stigma around homelessness through education and outreach campaigns. Furthermore, collaborative efforts between the city government, nonprofits, businesses, and the community at large will be essential to developing and executing a multifaceted strategy to address the root causes of homelessness and deliver effective, long-term solutions. Ultimately, tackling the homelessness crisis in New York City will require a sustained, compassionate, and holistic approach drawing upon a diverse range of resources and interventions.

Senior Citizens Living in Poverty

The issue of senior citizens living in poverty within the bustling metropolis of New York City is a pressing and complex social concern. According to the latest data, a significant portion of the city’s elderly population, many of whom have lived in the five boroughs for decades, are struggling to make ends meet and meet their basic needs. Factors contributing to this troubling trend include the high cost of living in NYC, which has skyrocketed in recent years, leaving many seniors on fixed incomes unable to afford necessities like rent, healthcare, and nutritious food. Additionally, some elderly New Yorkers lack robust retirement savings or pensions, having worked low-wage jobs throughout their lives, and now find themselves in financial precarity as they age. The problem is exacerbated by the isolation and lack of familial support networks that plague many senior citizens, particularly those living alone. Without robust social services and affordable housing options tailored to the unique needs of the elderly, far too many of New York’s seniors are forced to choose between paying for medicine or putting food on the table. Addressing this multifaceted challenge will require a concerted, collaborative effort between government, nonprofits, and community organizations to ensure that the city’s most vulnerable older residents can live out their golden years with dignity and security.

Struggling to Retire

Many New York City residents are finding it increasingly difficult to save enough money to retire comfortably. According to recent studies, a staggering number of NYC’s working population will not have sufficient funds to maintain their standard of living after they stop earning a regular paycheck. The high cost of living in the city, coupled with stagnant wage growth and the decline of traditional pension plans, has left a large portion of the workforce woefully unprepared for their golden years. Rent and housing costs consume a significant portion of many New Yorkers’ monthly budgets, leaving little room for substantial retirement contributions. Healthcare expenses also pose a major obstacle, as the rising price of medical care and insurance premiums eats away at potential savings. Additionally, the economic instability and market volatility of the past decade have depleted the nest eggs of countless city residents who saw their investments plummet. With pensions becoming rarer and Social Security benefits potentially reduced in the future, droves of New Yorkers are facing the prospect of not being able to afford to retire at all. This looming retirement crisis disproportionately impacts low-income and middle-class families who lack the means to adequately plan and save for their post-work lives. Without significant policy changes and increased financial education, the number of NYC residents unable to retire comfortably will likely continue to grow in the years to come.

No Paid Timeoff

Many New York City residents have found themselves in a difficult situation during the COVID-19 pandemic, as a significant portion of the city’s workforce lacks access to paid time off from work. While larger corporations and white-collar jobs may offer more generous leave policies, a substantial number of hourly wage earners, service industry employees, and gig workers in the city do not have the luxury of paid sick days, vacation time, or other forms of paid time off. This can create a precarious situation, especially for those working in industries deemed essential, who must choose between reporting to work while ill or forfeiting much-needed income. The lack of a federal paid leave mandate has exacerbated this problem, leaving it up to individual states and municipalities to establish their own policies – and New York City’s regulations, while more progressive than some areas, still fall short of providing comprehensive coverage. As a result, countless NYC residents have been forced to deplete their savings, take on debt, or make other financial sacrifices in order to care for themselves or their families when illness strikes, further straining already stretched household budgets. Addressing this disparity in access to paid time off has emerged as a critical priority, as ensuring workers can take time off without jeopardizing their livelihoods is essential for maintaining public health and supporting economic stability, especially during times of crisis.

Living With Student Loan Debt

New York City is home to a significant number of residents who are grappling with the burden of student loan debt. As one of the most populous and economically vibrant cities in the United States, NYC attracts students and young professionals from all over the country who flock to its world-class universities and abundant job opportunities. However, the high cost of living in the city, coupled with the skyrocketing price of tuition nationwide, has led to a substantial portion of the NYC population finding themselves saddled with substantial student loan obligations even years after completing their studies.

According to the latest data, it’s estimated that over 1.7 million New Yorkers, or roughly 20% of the city’s total population, are currently paying back student loans. The average NYC resident with student debt owes around $35,000, which is higher than the national average. This financial strain has profound implications, as these individuals often struggle to afford basic necessities like housing, food, and healthcare while funneling large portions of their incomes towards steadily accruing interest and principal payments. The student debt crisis has become a pervasive issue in New York, with many young professionals delaying major life milestones like homeownership, marriage, and starting families due to the weight of their educational loans. Policymakers and advocates continue to grapple with finding solutions to provide relief and support for the millions of NYC residents trapped in the student debt cycle.

Struggling With Credit Card Debt

According to recent data, a significant portion of New York City’s vast and diverse population is currently grappling with the burden of credit card debt. As one of the most expensive cities in the United States, the cost of living in the Big Apple can be staggeringly high, leading many residents to rely on credit cards to cover essential expenses like rent, groceries, and transportation. With the average credit card balance for New Yorkers hovering around $4,000, a sizable chunk of the city’s 8.8 million inhabitants are finding themselves trapped in a vicious cycle of minimum payments and compounding interest charges. This financial strain is especially pronounced for low-income families and individuals living paycheck-to-paycheck, who may turn to credit cards as a temporary solution to make ends meet, only to find themselves drowning in debt as they struggle to keep up with the mounting bills. The high cost of housing, healthcare, and other necessities in New York City exacerbates this problem, leaving many residents with little choice but to lean on credit cards to get by. Addressing this issue will require a multi-faceted approach, including financial education, debt management programs, and policy reforms to make the city more affordable for its hardworking residents.

Dealing With Medical Debt

A significant number of New York City residents find themselves burdened by crippling debt due to the exorbitant costs of medical care and treatment. In the nation’s largest city, where the high cost of living already strains household budgets, unexpected medical emergencies or chronic health issues can quickly spiral out of control financially. Even those with health insurance coverage often face steep deductibles, copays, and out-of-pocket maximums that leave them responsible for thousands of dollars in medical bills. And for the uninsured, a single hospital stay or surgical procedure can rack up tens or even hundreds of thousands of dollars in charges that they have no means to pay. This crushing medical debt forces many NYC residents to make agonizing choices – cutting back on essentials like food and housing in order to keep up with minimum payments, or simply avoiding seeking necessary care altogether out of fear of the financial consequences. The situation is particularly dire for low-income New Yorkers, who may lack access to quality, affordable healthcare options and have little financial cushion to absorb unexpected medical costs. Ultimately, the prevalence of medical debt in the five boroughs highlights the urgent need for healthcare reform and social safety net programs to protect vulnerable residents from financial ruin due to illness or injury.

Food Insecurity

Food insecurity is a pressing issue affecting far too many residents of New York City. According to the latest data, an estimated 1.2 million New Yorkers, or roughly 14% of the city’s population, are currently living with food insecurity. This means that these individuals and families lack consistent access to enough affordable, nutritious food to support a healthy lifestyle. The problem is particularly acute in low-income neighborhoods and communities of color, where poverty, unemployment, and lack of access to full-service grocery stores contribute to high rates of food insecurity. Many of these residents are forced to rely on emergency food providers like food pantries and soup kitchens just to put meals on the table. Even those who do not experience outright hunger often have to make difficult trade-offs, sacrificing proper nutrition in order to pay for other essential expenses like rent, utilities, and medical care. The widespread prevalence of food insecurity in the five boroughs is a stark reminder of the deep socioeconomic disparities that continue to plague the nation’s largest city, with devastating consequences for the health and wellbeing of vulnerable populations. Tackling this crisis will require a multi-pronged approach involving government, nonprofits, and communities working together to address the root causes and ensure all New Yorkers have access to the food they need to thrive.

The annual earnings for an FDNY (Fire Department of New York) employee can vary significantly based on their position, experience, and tenure. Entry-level firefighters typically start with a salary around $45,000 to $55,000 per year. However, as they gain experience and move up in rank, salaries can increase substantially. For instance, a lieutenant can earn between $80,000 to $100,000 annually, while battalion chiefs and higher-ranking officials can see salaries well over $150,000.

Additionally, FDNY employees often receive benefits such as health insurance, retirement plans, and overtime pay, which can further enhance their total compensation package. Overall, a career with the FDNY not only offers competitive salaries but also provides a sense of purpose and community service that is truly invaluable.

The annual earnings for an NYPD employee can vary significantly based on their position, experience, and rank. For example, entry-level police officers typically start with a salary around $42,000 to $45,000 per year, but this can increase substantially with overtime, longevity pay, and promotions.

As officers gain experience and move up the ranks, salaries can rise significantly; sergeants and lieutenants often earn between $80,000 and $110,000 annually. Detectives and higher-ranking officials can earn even more, with some captains and chiefs making well over $150,000 per year.

As of recent data, the annual earnings of the average NYC resident are approximately $70,000. This figure reflects the diverse economy of New York City, which encompasses a wide range of industries, from finance and technology to arts and hospitality. While living expenses in NYC are notably high, the average salary is a testament to the city’s dynamic job market and opportunities for career growth. For anyone considering a move to or career in NYC, this earning potential highlights the city’s ability to attract talent and provide competitive compensation.

As of recent data, approximately 1.8% of New York City residents earn the minimum wage, which is currently set at $15 per hour. This percentage translates to around 100,000 workers across various industries, including retail, hospitality, and food service. While this figure may seem small in relation to the city’s overall population, it highlights the significant number of individuals and families who depend on minimum wage salaries to make ends meet in one of the most expensive cities in the world. The struggles faced by these workers emphasize the importance of ongoing discussions around wage increases and economic support to ensure a living wage for all New Yorkers.

Healthcare Costs for Active and Retired NYPD and FDNY Personnel

The healthcare costs associated with active and retired members of the New York Police Department (NYPD) and Fire Department of New York (FDNY) represent a significant portion of New York City’s budget. These costs arise from the need to provide comprehensive medical care to the city’s first responders, who often face occupational hazards that can lead to both acute and chronic health conditions.

Overview of Healthcare Benefits

Active Personnel

For active members of the NYPD and FDNY, healthcare benefits typically include:

-

Medical and Dental Coverage: Comprehensive medical insurance covers hospital visits, surgeries, preventive care, and dental services.

-

Mental Health Services: Access to mental health support is crucial due to the high-stress nature of their jobs.

-

Prescription Drug Plans: Coverage for necessary medications is provided to manage both short-term conditions and chronic illnesses.

Retired Personnel

Retired members often continue to receive healthcare benefits, which may include:

-

Lifetime Health Coverage: Many retirees are eligible for lifetime health benefits, which can be a significant financial commitment for the city.

-

Medicare Coordination: Once eligible, retirees are required to enroll in Medicare, with the city often covering additional costs not covered by Medicare.

-

Specialized Care for Job-Related Illnesses: Retirees may also receive specialized care for illnesses and injuries acquired during their service, such as those related to exposure to hazardous materials.

Financial Impact on New York City

Budget Allocation

New York City allocates a substantial portion of its budget to cover the healthcare costs of both active and retired NYPD and FDNY personnel. This allocation includes:

-

Annual Budgeting: The city must plan annually for these expenses, ensuring adequate funding is available.

-

Pension and Benefits Funds: These funds are established to manage long-term liabilities related to retiree healthcare.

Challenges and Considerations

-

Rising Healthcare Costs: The increasing costs of healthcare services and prescription drugs pose a challenge to maintaining sustainable funding.

-

Aging Workforce: As more personnel retire, the financial burden on the city increases, necessitating careful planning and management.

-

Health Risks and Occupational Hazards: The unique risks associated with police and firefighting work often lead to higher-than-average healthcare needs.

Strategies for Cost Management

To manage these significant costs, New York City may employ several strategies:

-

Negotiating Better Rates: Working with healthcare providers to negotiate more favorable rates for services and medications.

-

Preventive Health Programs: Implementing programs aimed at reducing the incidence of chronic diseases and improving overall health and wellness among active personnel.

-

Wellness and Rehabilitation Initiatives: Encouraging participation in wellness and rehabilitation programs to maintain the health of both active and retired members.

In conclusion, while the healthcare costs for NYPD and FDNY personnel are substantial, they are a necessary investment in the health and well-being of those who protect and serve New York City. By implementing strategic measures, the city can strive to manage these costs effectively while ensuring that its first responders receive the care they deserve.

Understanding the Cost of Health Insurance in New York City

The cost of health insurance in New York City varies significantly based on several factors such as age, health conditions, income, and the type of plan chosen. Whether you’re an individual, part of a family, or a small business owner, understanding these costs can help you make informed decisions about your health coverage.

Factors Influencing Health Insurance Costs

1. Type of Plan

Health insurance plans, typically categorized as HMO, PPO, EPO, or POS, each come with different premium costs and levels of flexibility:

-

HMO (Health Maintenance Organization): Usually, the most affordable option with a network of doctors and hospitals.

-

PPO (Preferred Provider Organization): Offers greater flexibility in choosing healthcare providers but often at a higher cost.

-

EPO (Exclusive Provider Organization): Similar to PPO but typically doesn’t cover out-of-network care.

-

POS (Point of Service): Combines features of HMO and PPO plans, with varying costs.

2. Level of Coverage

Plans are also divided into different tiers, known as metal levels, which affect premiums and out-of-pocket costs:

-

Bronze: Lower monthly premiums but higher costs when care is needed.

-

Silver: Moderate premiums and moderate costs when care is required.

-

Gold: Higher premiums with lower out-of-pocket costs.

-

Platinum: Highest premiums but lowest costs when receiving care.

3. Age and Health Status

Older individuals and those with pre-existing conditions may face higher premiums. However, due to the Affordable Care Act, insurers can’t deny coverage or charge higher rates based on health issues.

4. Income Level

Subsidies are available for individuals and families earning less than 400% of the federal poverty level, reducing the cost of premiums.

Average Costs

In 2023, the average cost of health insurance for a 40-year-old individual in New York City ranges from approximately $450 to $600 per month for a Silver plan. Family plans can range from $1,200 to $1,800 per month, depending on the number of members and the plan selected.

Tips for Reducing Health Insurance Costs

-

Shop Around: Compare plans on the New York State of Health marketplace to find the best deal.

-

Consider Subsidies: If eligible, apply for subsidies to lower premium costs.

-

Review Your Needs: Regularly assess your health needs and adjust your plan accordingly to avoid overpaying.

-

Use In-Network Providers: Stick to healthcare providers within your plan’s network to minimize out-of-pocket expenses.

Understanding the nuances of health insurance can be challenging, but taking the time to research and compare options can lead to significant savings while ensuring you have the coverage you need.

Understanding Pension Costs for NYPD and FDNY

The New York Police Department (NYPD) and Fire Department of New York (FDNY) are two of the most crucial public services in New York City. Ensuring the safety and well-being of its citizens comes with significant costs, not only in terms of operational expenses but also in providing for the retirement security of its personnel. This includes pensions, which are a critical component of the compensation package for these public servants.

Overview of Pension Systems

Pensions for the NYPD and FDNY are funded through a combination of employee contributions, investment earnings, and contributions from New York City. These pensions provide a guaranteed income for retired personnel, acknowledging the risks and demands associated with their service.

Key Features of NYPD and FDNY Pensions

-

Defined Benefit Plans: Both departments operate under defined benefit pension plans, which guarantee a specific retirement benefit amount based on salary and years of service.

-

Contribution Rates: Employees contribute a portion of their salary towards their pension. The city is responsible for making up any shortfall to ensure the pension fund remains solvent.

-

Retirement Age and Service Requirements: Typically, personnel can retire after 20 to 25 years of service, allowing many to retire in their 40s or 50s. This early retirement eligibility increases the time over which pensions are paid.

Financial Impact on New York City

The pension obligations for NYPD and FDNY personnel represent a substantial financial commitment for New York City.

Factors Influencing Pension Costs

-

Longevity: As life expectancy increases, the duration over which pensions are paid also extends, impacting overall costs.

-

Investment Performance: The pension funds rely on investment returns to cover a portion of the benefits. Poor market performance can increase the city’s financial liability.

-

Salary Increases: Pension benefits are typically calculated based on a percentage of the final average salary, meaning that higher salaries lead to higher pension payouts.

Budgetary Considerations

The city allocates a significant portion of its annual budget to cover these pension costs. In recent years, this has been a topic of discussion and concern, especially in light of economic fluctuations and budget constraints.

Addressing Pension Sustainability

Ensuring the sustainability of pension systems for the NYPD and FDNY is crucial for the city’s financial health and for honoring commitments to its public servants.

Potential Solutions

-

Reforming Contribution Structures: Adjusting the contribution rates for new hires can help balance the financial burden between employees and the city.

-

Investment Strategy Adjustments: Diversifying investments and adopting more conservative assumptions can mitigate risks associated with market volatility.

-

Policy Revisions: Implementing changes such as modifying the pension formula or retirement age for new employees could help control future costs.

Conclusion

Pension costs for the NYPD and FDNY are a vital aspect of New York City’s fiscal responsibilities. Balancing the need to provide fair retirement benefits with the city’s financial capabilities requires careful planning and ongoing evaluation. As the city navigates these challenges, open dialogue and strategic decision-making will be key to ensuring the long-term viability of these crucial pension systems.

Pensions in New York City and New York State

Understanding the landscape of pensions in New York City and New York State requires examining data from various public and private sector sources. While exact numbers can vary over time due to changes in employment and policy, we can provide a general overview based on recent data.

Public Sector Pensions

In New York State, public sector pensions are primarily managed by several large retirement systems:

-

New York State and Local Retirement System (NYSLRS): This system serves state employees and local government employees outside of New York City.

-

New York State Teachers’ Retirement System (NYSTRS): This system serves public school teachers and administrators outside of New York City.

-

New York City Employees’ Retirement System (NYCERS): This is the largest municipal public employee retirement system in the United States, covering a variety of public sector employees in New York City.

-

Teachers’ Retirement System of the City of New York (TRSNYC): This system covers public school teachers and other educational personnel within New York City.

-

New York City Police Pension Fund and New York City Fire Department Pension Fund: These funds specifically cover police officers and firefighters in New York City.

Estimated Numbers

-

NYSLRS: As of recent data, NYSLRS had over 1 million members, including active employees and retirees.

-

NYSTRS: Serves approximately 430,000 active and retired members.

-

NYCERS: Covers over 350,000 active and retired members.

-

TRSNYC: Encompasses around 200,000 members including active participants and retirees.

-

Police and Fire Department Funds: Combined, these cover tens of thousands of active and retired members.

Private Sector Pensions

In addition to public pensions, many individuals in New York City and New York State are covered by private sector pension plans. These vary widely by industry and employer, and the number of participants can be difficult to quantify precisely.

Trends

-

Decline of Defined Benefit Plans: Over the years, there has been a shift from defined benefit plans (traditional pensions) to defined contribution plans (such as 401(k)s). This affects the number of people relying solely on traditional pension plans.

-

Union Influence: In certain industries such as construction, transportation, and healthcare, unionized employees often have access to pension plans negotiated as part of their collective bargaining agreements.

Conclusion

While it’s challenging to provide an exact number of people with pensions in both New York City and New York State due to the variability and complexity of pension systems, it is clear that hundreds of thousands, if not over a million, individuals are part of these pension systems. Public sector pensions remain a significant component of retirement security for many New Yorkers, while the private sector continues to adapt to changing economic and employment landscapes.

The Firefighters Association of the State of New York (FASNY) commissioned Resolution Economics (ResEcon), a national firm of economists and policy analysts, to measure the economic value that volunteer firefighters provide to New York residents. In completing this assignment, ResEcon analyzed both paid and volunteer fire departments throughout the state, excluding New York City. We employed economic models to measure firefighting requirements in each locality, using not only population but also geography, real property, service areas, and local experience.

Poverty in New York City is rising at a startling rate and it’s affecting the city’s most vulnerable residents — children, according to a newly released report.

More than half of New York City residents, including a quarter of all children, live in poverty or are low-income, according to the Poverty Tracker Annual Report from Columbia University and the philanthropic organization Robin Hood.

Researchers surveyed a sample of 3,000 New York households for three months to track data on employment, assets, debts and health.

Yes, some people are leaving New York City due to high taxes, but others are staying put or even moving there:

-

People leaving

Lower- and middle-income New Yorkers are leaving the state in greater numbers than the wealthy. In 2023, the group of people who left the state with incomes between $104,000 and $172,000 was the second largest.

-

People staying put or moving in

The number of millionaires in New York has increased, and the richest New Yorkers are leaving the state at a much lower rate than other income groups.

-

Tax revenue

New York state and city tax revenue has held up better than expected, and the state’s income tax receipts rose 58.5% from 2019 to 2022.

NEW YORK CITY’S ISSUES WITH HANDLING FUNDS APPROPRIATELY